Navigating the path to financial independence is a journey that begins early, ideally in our 20s, setting the stage for success in our 30s and beyond. The financial habits we establish during these formative years are critical, yet many of us come into adulthood without a clear blueprint for financial success. This lack of guidance need not be a barrier to wealth accumulation. Through diligent research and the wisdom of financial experts, a set of core principles has emerged, offering a roadmap for young adults to achieve financial stability and growth. By adopting these habits now, you can ensure a future where financial stress is minimized and prosperity is within reach.

The 25% Housing Rule

One of the most significant financial challenges we face is managing housing costs, which for many, consume a substantial portion of monthly income. Financial experts advocate a more conservative approach than the traditional one-third guideline, suggesting that no more than 25% of your monthly net pay should go towards housing. This strategy, whether you’re renting or buying, is pivotal in preventing the common pitfall of living paycheck to paycheck. It allows for greater flexibility in your budget, enabling you to allocate resources towards savings, investments, and other areas that contribute to wealth building. By adhering to this rule, you lay a strong foundation for financial health, avoiding the trap of excessive debt and limited savings that plagues many households.

The 10% Entertainment Rule

While embracing life’s pleasures is important for a balanced lifestyle, unchecked spending on entertainment and leisure can quickly erode your financial stability. The wisdom here lies in moderation; specifically, limiting entertainment expenses to no more than 10% of your monthly net income. This guideline encourages a mindful approach to spending, ensuring that you can enjoy dining out, movies, and social events without undermining your financial goals. It’s about finding joy in the experiences you value most while maintaining the discipline to save and invest for the future. This balance is key to building a life that is not only financially secure but also rich in experiences that bring genuine happiness.

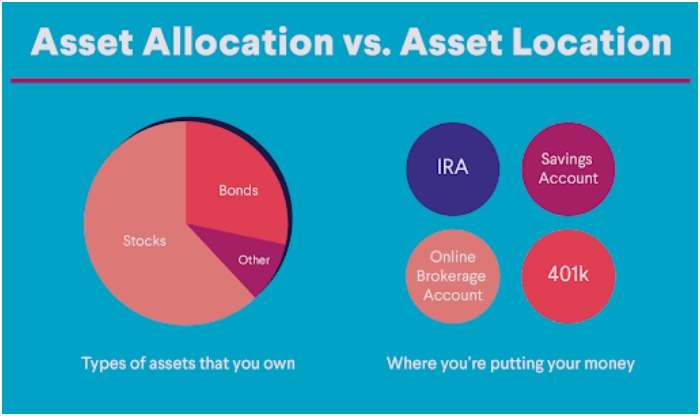

Diversifying Your Wealth

The journey to financial independence is accelerated by the ability to earn passive income. This involves diversifying your investments across a range of assets such as stocks, bonds, real estate, and precious metals. By allocating 25% to 50% of your savings to investments, you take advantage of compound interest and market growth, allowing your wealth to expand without direct, active involvement. This strategy mirrors the practices of the financially successful, who often have multiple streams of income, providing a buffer against economic downturns and enhancing their financial security. The key is to align your investment choices with your risk tolerance and long-term goals, ensuring that your portfolio grows and adapts with you over time.

The Role of Relationships in Achieving Success

The adage that no one achieves success alone holds true in the realm of financial prosperity. Networking and cultivating meaningful relationships are indispensable to personal and professional growth. It’s notable that a significant majority of wealthy individuals invest time in building networks, contrasting with the less affluent. This involves seeking out mentors, fostering genuine friendships, and connecting with individuals who inspire and challenge you. These relationships can open doors to new opportunities, offer invaluable advice, and provide support through life’s ups and downs. Beyond professional networking, maintaining close connections with friends and family enriches your life, offering a sense of community and belonging that is priceless.

Lifestyle Choices That Complement Financial Goals

Beyond these core financial habits, certain lifestyle choices can significantly impact your productivity and overall success. Regular physical activity, for example, has been touted by business leaders like Richard Branson for boosting productivity. Similarly, a habit of voracious reading, as practiced by Warren Buffett, can expand your knowledge and understanding, fueling personal and professional growth. These activities not only enhance your capacity for success but also improve your quality of life, proving that personal well-being and financial health are interconnected.

The Ultimate Investment: Yourself

Above all, the most profound advice from self-made millionaires is the imperative to invest in oneself. This encompasses education, skill acquisition, personal development, and health. Continuously seeking to learn and grow ensures that you remain adaptable and competitive in an ever-changing world. This investment in yourself is the cornerstone of a fulfilling career and a prosperous life.

In conclusion, the path to financial success in your 30s is paved in your 20s, through the adoption of disciplined spending, strategic investing, and the cultivation of supportive relationships. By integrating these habits with lifestyle choices that prioritize well-being and continuous learning, you set the stage for a future marked by financial freedom and personal fulfillment. Embracing these principles not only secures your financial future but also enriches your life with experiences, knowledge, and relationships that are invaluable.