As college tuition continues to rise, the question of who should bear the financial burden becomes more pressing. While college is a valuable opportunity, it’s not a mandatory path for everyone. If your child chooses to pursue higher education, encouraging them to take financial ownership of their education is not only reasonable but empowering. This approach fosters responsibility and instills valuable money management skills. Here are ten practical college savings tips for students, offering a roadmap to handle college expenses wisely and establish a solid foundation for their financial future.

1. Harness the Power of Scholarships

Scholarships are essentially free money for education that doesn’t require repayment. Encourage your child to actively seek out and apply for scholarships in areas where they excel, such as academics, athletics, or extracurricular activities. Even smaller scholarships can accumulate into significant savings. Treating scholarship applications like a part-time job can yield substantial rewards, easing the financial strain of college expenses.

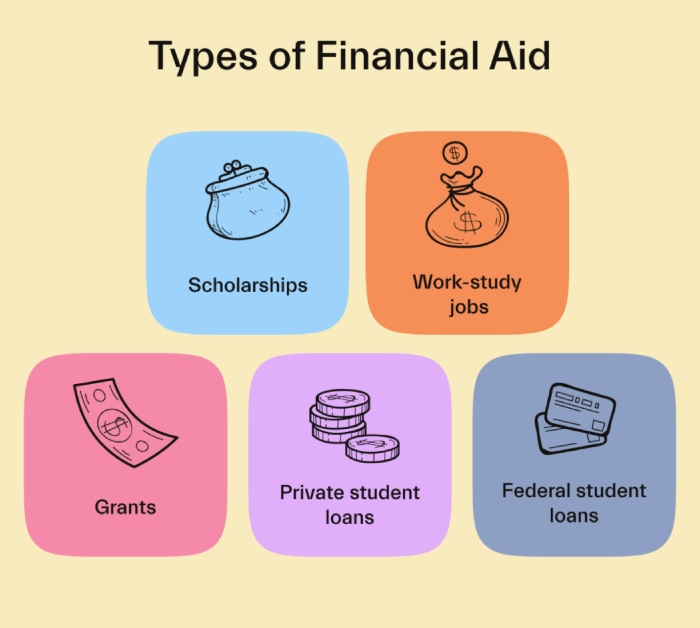

2. Explore Financial Aid Opportunities

Completing the Free Application for Federal Student Aid (FAFSA) is crucial for anyone considering college. This form helps determine eligibility for grants, work-study programs, and other aid forms. Caution is needed, however, as FAFSA also outlines available student loans, which should be avoided due to their long-term financial impact. Reading the fine print of any financial aid package is essential to ensure it’s not a loan disguised as aid.

3. Utilize Advanced Placement (AP) Classes

Enrolling in AP classes during high school is a strategic way to earn college credits early. This approach can save on tuition costs and fast-track your child’s academic journey. While these classes may have nominal fees, they are substantially lower than typical college course fees. Discuss available AP courses or dual enrollment options through local community colleges with your child’s academic counselor.

4. Encourage Part-Time Employment

Working part-time during the summer or the school year allows your child to save for college while gaining valuable work experience. Jobs such as lawn mowing, dog walking, or retail work contribute to college funds, provide practical skills, and enhance their resume. Learning to balance work and studies is an invaluable life lesson.

5. Open a Savings Account

Setting up a student checking and savings account is a smart way for your child to manage their earnings. These accounts often come with benefits like no maintenance fees and help inculcate habits of saving, spending, and budgeting. If your child is a minor, you’ll need to be a joint account holder, offering a chance to guide them in financial management.

6. Prioritize Saving Over Spending

Teach your child the importance of saving a portion of their income immediately. This habit prevents impulsive spending and builds a savings culture. Consider matching their savings to motivate them to save more, thus amplifying their college fund.

7. Steer Clear of Student Loans

Emphasize the importance of avoiding student loans, as they lead to long-term financial burdens. Explore alternatives like transferring to more affordable schools or taking a break to work and save if necessary. The goal is to graduate debt-free, even if it requires tough choices like delaying education or switching institutions.

8. Opt for Affordable Educational Institutions

Ivy League schools might be prestigious, but state schools offer similar programs at a fraction of the cost. Encourage your child to consider local options to save on tuition, moving, and travel expenses. Choosing a less expensive school doesn’t mean compromising on the quality of education but rather optimizing the cost-benefit ratio of their college experience.

9. Consider Living at Home

Staying at home during college can save thousands in room and board expenses. This option also allows your child to enjoy home-cooked meals and family time, reducing the need for expensive campus meal plans. Living at home doesn’t mean missing out on campus life; they can still actively participate in clubs and activities.

10. Seek Tuition Reimbursement Opportunities

Encourage your child to look for part-time jobs with companies offering tuition reimbursement. This benefit helps offset college costs and provides valuable professional experience. When job hunting, prioritize employers known for supporting student workers through educational benefits. This approach contributes financially and enhances their resume, offering a dual advantage in their career journey.